- #How to organize inventory for small business plus

- #How to organize inventory for small business free

When you think of your time as money, the increased time you spend on payroll costs your company money.

As you add more employees, payroll becomes more time consuming, which pulls you from duties that help generate income. When you start with one or two employees, handling payroll yourself may be doable. For example, as your retail store grows and demands more inventory, you might find a different vendor with better pricing for larger bulk orders you now place. A regular system of looking at your expenses and finding ways to reduce them periodically helps you stay on top of savings as your company grows and your needs change. Reducing business expenses isn’t a one-time activity. Shopping around for insurance and other essential services to find the lowest rates.Negotiating all rates for physical products and services.Pooling resources with other small businesses, such as using buying groups.

#How to organize inventory for small business free

Using free or inexpensive marketing methods, such as word of mouth and social media.Bartering services with other small businesses.Paying bills on time to avoid late fees.Improving the energy efficiency of your office space.Automating processes to reduce staffing needs.Working from home or downsizing office space.Video conferencing with long-distance clients to reduce travel costs.Going paperless to save on office supplies like ink and paper.Some ways your business may be able to cut costs include: Look for areas that eat up a large amount of your revenue or things that cost more than they should. QuickBooks makes it easy to check on all of your spending. To find areas to reduce expenses, you need an accurate, updated accounting of everything you spend. Even though those expenses are necessary, it’s usually possible to reduce your costs so you can improve your profit margins and have more money to invest back into your business. When you run a small business, you incur costs, from buying inventory to paying employees. Choosing the best structure for your situation helps you maximize tax breaks and minimize personal liability. This option requires more work to establish, and you have greater accounting responsibilities.īut you also relieve yourself of the personal liability should your business go into debt. When you incorporate your business, you legally make it a separate entity so it’s independent of you. You can still be personally accountable for the debts of your business as a partnership. When you file your taxes, you claim your percentage in income or expenses. You might split it 50/50 with one other person, or one person might have 20%, another 30%, and a third partner 50%. When you form a partnership, you typically decide what percentage each partner has in the business.

#How to organize inventory for small business plus

The plus side is that in case of a business loss, you may be able to reduce your overall tax liability.īusiness partnerships shift the liability from a single owner to two or more owners, or partners, who run the business. In other words, you’re personally liable for your company’s finances, including debts that it incurs. You can’t be separated from your business if you’re a sole proprietor. A sole proprietorship is the easiest to set up, which is why many small business owners start out this way. For example, a business needs to keep a higher level of inventory during a peak season.The business structure you choose affects how you pay taxes and your personal financial liability.

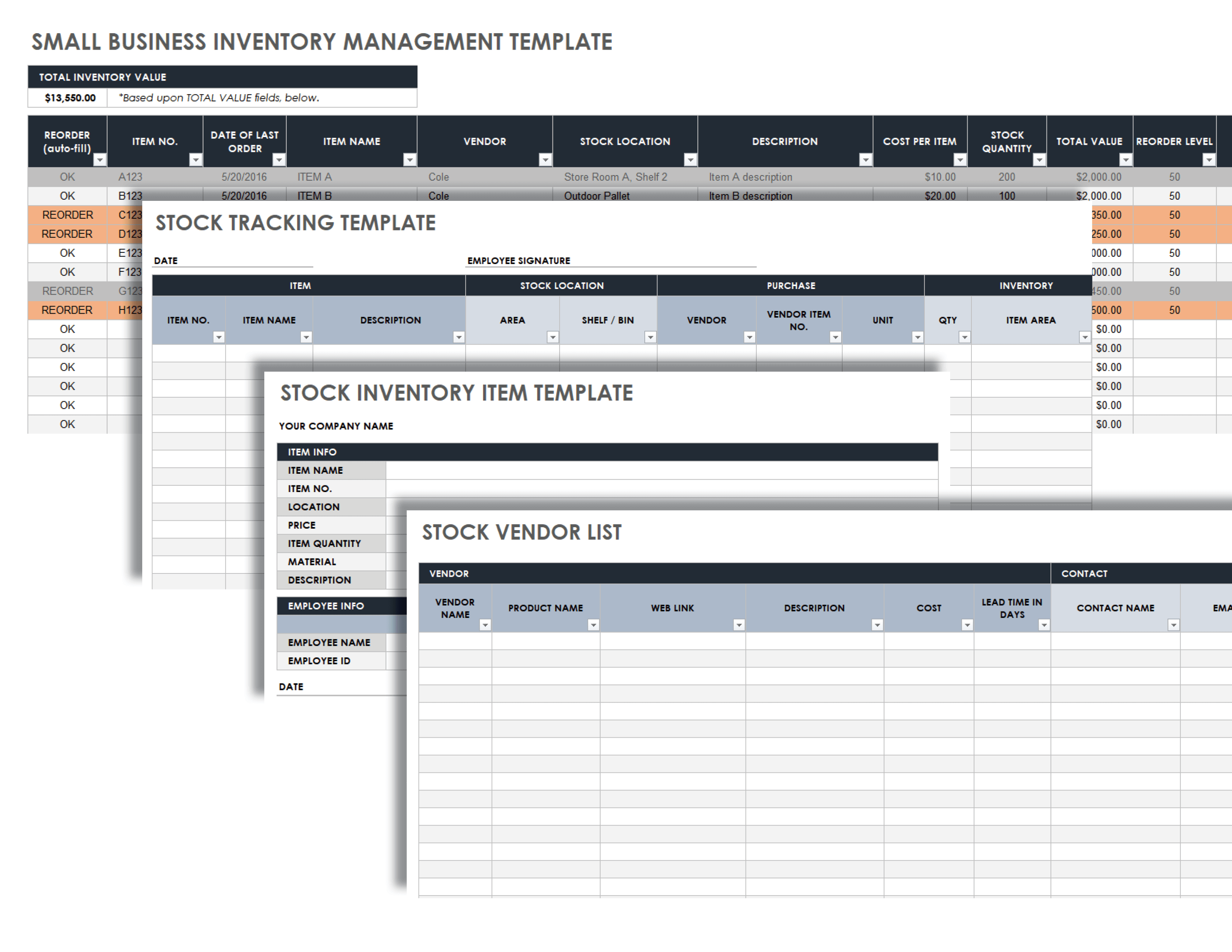

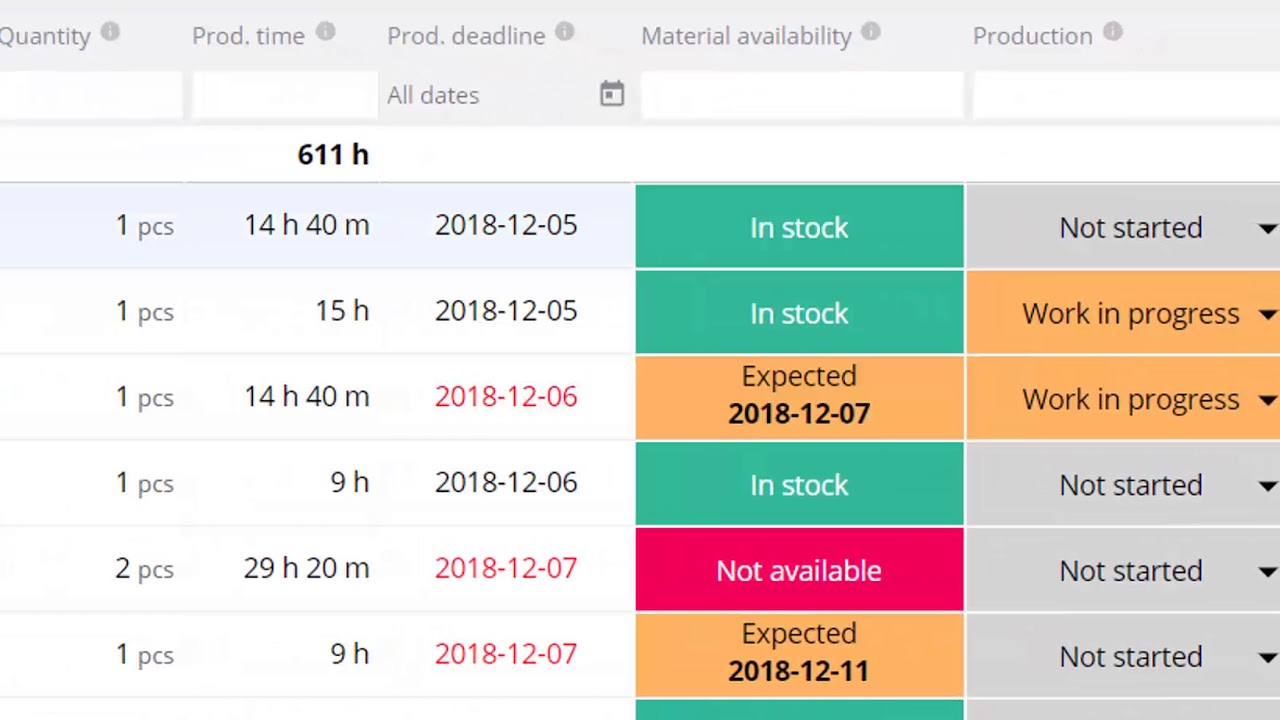

Available space in the warehouse: More storage space can hold more inventory.Typically, the company needs to hold more stock if the supplies tend to run out quickly. The rate at which the stock is used up: This is also known as the stock turnover rate.Here are some factors influencing the level of stock: Reserved inventory also serves as a buffer for unpredictable events such as natural disasters or economic crises. Having the right level of inventory is important as it allows the company to keep up with the production while waiting for new materials to arrive.

Lifestyle and Technological Environment.Market Segmentation, Targeting, and Positioning.Risks and Rewards of Running a Business.Employee Motivation and Engagement Strategies.

0 kommentar(er)

0 kommentar(er)